A few weeks ago I shared a guest post from divorce coach Karen McMahon about Envisioning and Creating Your Future. At the time I was grappling with the decision to end my marriage, I didn’t have the formal word for it, but visioning helped me see that divorce was indeed an option and it was visioning that helped guide me through my fears about divorce. Here’s how:

I Just Want To Be Happy

In January 2006, I sat in a board meeting for a non-profit health clinic and listened as one my fellow board members told us she was getting divorced after over twenty years of marriage:

“I’ve decided if I have to support my husband for the rest of my life, I may as well be divorced and happy.”

For the next few weeks, her words kept reverberating in my head. I had been married for almost sixteen years. To the outside world, we could be the perfect couple – beautiful home, nice neighborhood, two beautiful kids, ski house, overseas vacations and so on. I’d taken a severance package from my corporate job in financial services a couple of years before and was taking some time off contemplating a second career as a journalist/writer. He was a teacher but had been a stay-at-home dad for a few years while looking for something new.

From the inside however, it was a struggle. From my perspective, it was a common story of two people who had grown apart. I was in my late forties, feeling that my life was certainly more than half over and knowing that I couldn’t continue living the way I was. Up until then though, I couldn’t bring myself to consider divorce. No one in my family had been divorced and I had no divorced friends. I had no role model. It wasn’t going to happen to me. But I kept hearing my friend. I wanted to be happy too. So what was holding me back?

From the inside however, it was a struggle. From my perspective, it was a common story of two people who had grown apart. I was in my late forties, feeling that my life was certainly more than half over and knowing that I couldn’t continue living the way I was. Up until then though, I couldn’t bring myself to consider divorce. No one in my family had been divorced and I had no divorced friends. I had no role model. It wasn’t going to happen to me. But I kept hearing my friend. I wanted to be happy too. So what was holding me back?

Live As If You Were Divorced

A few weeks after hearing my friend, I started to see a counselor on my own. I didn’t tell my husband I was seeing her. I didn’t tell any of my friends what was going on. I didn’t tell them because they were “our” friends, they were all couples we saw together. If I confided in them, I felt it would immediately change the social dynamic. I was feeling very alone. Slowly and gradually my counselor got me to start imagining my life if I were to divorce. For everything I did, I had to imagine how it would be if my husband and I were living apart. Where would we each be living, how would the kids get to school, how would they get home, who would help them with their homework, what would happen when they were sick, how would bedtimes work, how would we handle the logistics of after-school activities? How did I think the children would respond? And how would I feel being apart from the kids when it was my husband’s parenting time?

Create A Post-Divorce Budget

I had been the primary breadwinner for the entire time of our marriage. I had been well compensated throughout my career and we’d lived well within our means. Using my industry knowledge, I’d planned our finances carefully. I assumed a divorce would mean an equitable split of the assets. That would certainly mean giving up on retiring early, giving up half the retirement nest egg, giving up the large house, giving up the no budget lifestyle and maybe even giving up on going to journalism school – my second career dream.

As the household bill payer, I knew everything about our finances so I put all our assets into a spreadsheet, estimated the current values and what it would look like if everything was split. I’ve used Quicken for many years, so I knew what our monthly expenses were and from there I created a budget for myself – something I hadn’t had for many years. I compared that to what would be my half of the assets and started to think that maybe this wasn’t so impossible. I realized that my fears of having to live month-to-month were unfounded.

No, I wouldn’t be able to keep the house but I didn’t want the house – it was too big – my two children and I didn’t need 5,500 square feet and an acre of yard. I didn’t want the expense or responsibility of maintaining it. A smaller house in the same town would be better for us and would lower my living expense.

I didn’t want the ski house either. The ski weekends had come to be work rather than leisure.

No, I wouldn’t be able to retire early but if I was able to negotiate some additional funds in the settlement, I would be able to finish my masters, and build a second career. It would allow me to work part time until our children were through high school which I felt was important to their well-being and it was something I really wanted to do, having worked full-time since they were infants. Yes, it would probably mean working until at least normal retirement age but that didn’t seem like a sacrifice.

Dealing With Child Support

The assets we had would certainly provide both of us with the wherewithal to cover expenses related to the children but it would mean negotiating child support payments each month. The thought of that produced a knot in the pit of my stomach. We each had different approaches to money and had never resolved that during our marriage choosing instead to sidestep the issues. I knew child support would be a legal arrangement and there would be legal recourse if necessary but I’d come to realize I wasn’t good with conflict and I wanted a way to avoid conflict over the children.

So again, I turned to a spreadsheet. I’m not sure what made me think of this but I decided to project out what the children’s expenses would be through to the end of high school and college. I asked our financial adviser what I should assume for college expenses and an inflation factor. Then I took the net present value of that large amount, less the value of their 529 College savings plans and that was what I proposed to set aside in a trust to cover the children’s expenses. It’s sounds complicated but it really isn’t that difficult, just detailed.

According to my attorney, the trust was an unusual arrangement but there was provision for it under Colorado state law and while there was inevitably some negotiating around the division of assets, my husband agreed with the concepts. The trust document specifies what the trust funds can and can’t be used for and it does mean that all expenses related to the children have to be segregated from my or my ex’s personal expenses.

So far it has spared us what seems to be the typical child support wrangling. My ex and I don’t discuss normal day-to-day expenses and for non-routine expenses we do generally see eye-to-eye. I think the fact that there is an existing pool of money that is being drawn on fosters this agreement. I believe the discussion would be very different if we individually had to come up with the funds for the big ticket items.

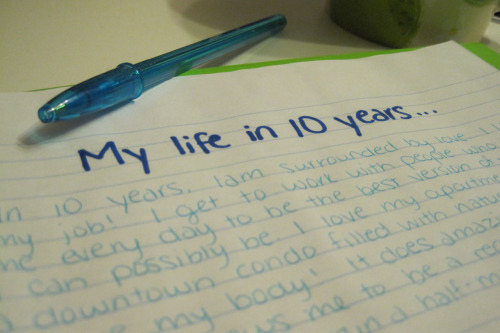

Moving Forward With A Vision

The financial piece of the vision may make this seem cold and calculating. For me, what it was was details that helped me accept that divorce was an option. Divorce researcher Margaret Brinig* has argued that divorce is an opportunistic event – the person who initiates divorce has to see that their life after divorce will in some way, shape or form be better. I believe she’s right. Seeing my life as potentially better after divorce is what this visioning process did for me.

Does that mean that creating a vision only applies to those who initiate divorce. Absolutely not. For the “leavee” this process helps with negotiating both the financial and the parenting agreement in the legal process. Thinking through in this level of detail can help to avoid mistakes from decisions made in shock. The process can also help with accepting that the marriage is over and while you don’t have to like it, accepting the decision enables you to move forward with your life.

Did you create a vision went your divorce started? How did you go about it? What steps did you go through? Was it helpful?

Photo credit: lululemon athletica

*”‘These Boots Are made for Walking’: Why Most Divorce Filers Are Women,” Margaret Brinig, Douglas Allen, American Law and Economics Review V2 N1 2000 (126-169).